All Categories

Featured

The ideal option for any type of individual ought to be based upon their existing situations, tax obligation situation, and monetary objectives. Annuity interest rates. The cash from an inherited annuity can be paid as a single swelling amount, which ends up being taxable in the year it is received - Multi-year guaranteed annuities. The disadvantage to this alternative is that the revenues in the agreement are dispersed first, which are exhausted as ordinary earnings

If you do not have a prompt demand for the money from an acquired annuity, you could pick to roll it right into an additional annuity you manage. Through a 1035 exchange, you can guide the life insurance provider to move the cash from your acquired annuity into a new annuity you establish. If the acquired annuity was initially established inside an Individual retirement account, you might trade it for a certified annuity inside your very own Individual retirement account.

It is usually best to do so as soon as feasible. This will ensure that the settlements are gotten without delay which any problems can be taken care of rapidly. Annuity recipients can be opposed under specific scenarios, such as disputes over the credibility of the beneficiary classification or insurance claims of unnecessary impact. Get in touch with lawyers for advice

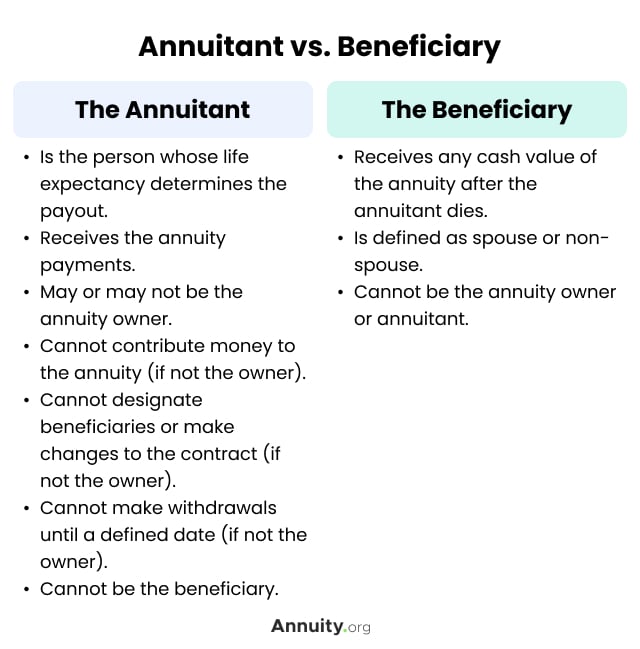

in disputed beneficiary situations (Period certain annuities). An annuity fatality benefit pays a set total up to your beneficiaries when you pass away. This is various from life insurance coverage, which pays a survivor benefit based upon the stated value of your policy. With an annuity, you are essentially buying your own life, and the death benefit is suggested to cover any type of superior expenses or financial debts you may have. Beneficiaries get repayments for the term defined in the annuity contract, which could be a fixed duration or for life. The timeframe for cashing in an annuity varies, however it often drops in between 1 and ten years, depending on agreement terms and state legislations. If a recipient is disabled, a lawful guardian or somebody with power of lawyer will certainly handle and receive the annuity settlements on their part. Joint and recipient annuities are the two sorts of annuities that can prevent probate.

Latest Posts

Understanding Fixed Index Annuity Vs Variable Annuity A Comprehensive Guide to Variable Vs Fixed Annuity Breaking Down the Basics of Investment Plans Benefits of Annuity Fixed Vs Variable Why What Is

Decoding Annuities Fixed Vs Variable Everything You Need to Know About Fixed Vs Variable Annuity Pros Cons What Is the Best Retirement Option? Benefits of Choosing the Right Financial Plan Why Choosin

Decoding How Investment Plans Work A Closer Look at How Retirement Planning Works What Is the Best Retirement Option? Pros and Cons of Fixed Annuity Vs Variable Annuity Why Choosing the Right Financia

More

Latest Posts